Micro Strategy, Paypal, Mastercard, Visa, Tesla, El Salvador. What a year 2021 has been and it’s only half way through. By the end of the year we could see Paraguay, Panama, Argentina, Brazil, Colombia, and Mexico added to that list.

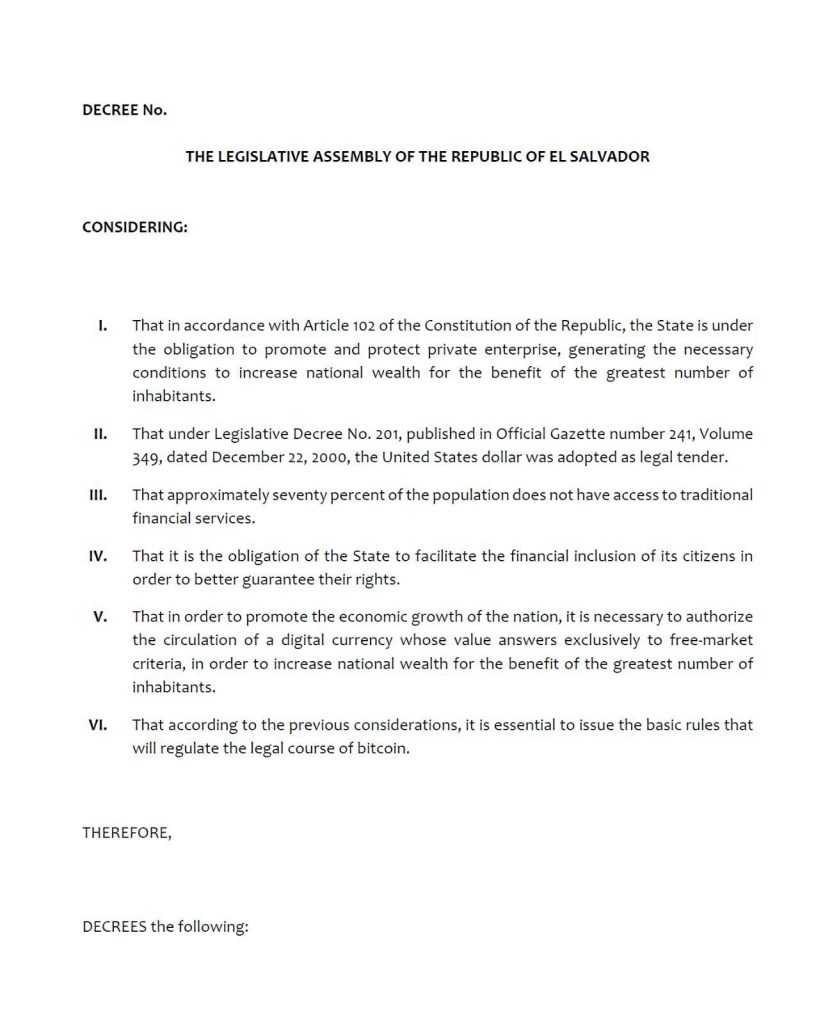

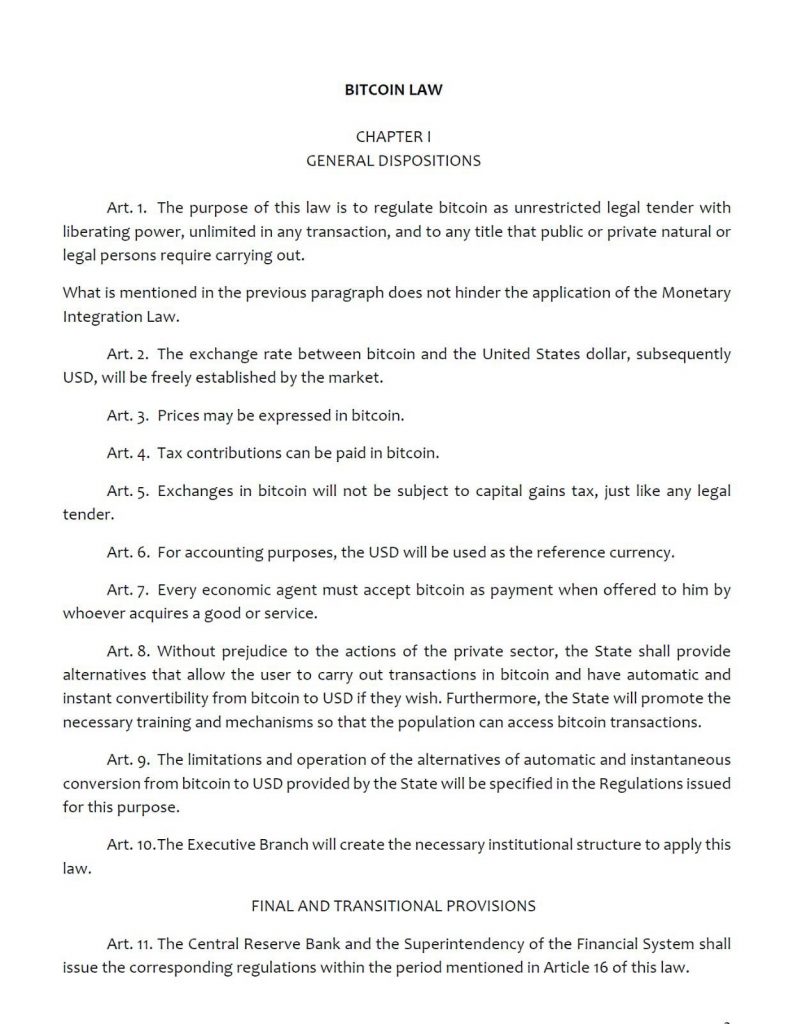

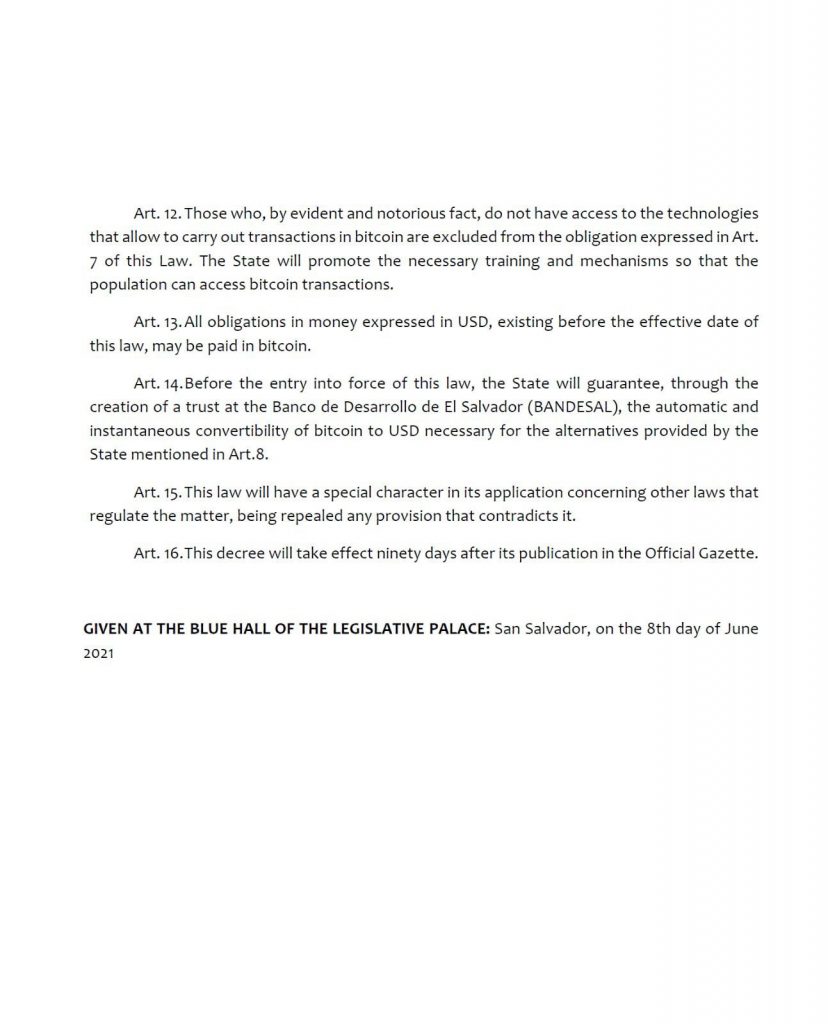

If you haven’t heard the news yet The President of El Salvador Nayib Bukele signed into law that bitcoin is as of the 9th June 2021 legal tender in El Salvador. The Salvadoran Congress voted yes 62, no 22. The full implications of this will take time to become fully evident but it’s a major step in the world wide adoption of bitcoin.

Before this past weekend most in the digital asset space would have known very little about El Salvador. The end of the bitcoin conference in Miama was an emotional one. If you missed the conference here is the segment where Jack Mallers of Strike got us up to speed as to what was happening in El Salvador.

Even after watching that I don’t think many were thinking it would happen as quickly as it has. The President tweeted the law as he sent it to congress earlier today.

That in itself was interesting to see and read. The day got more interesting when Nic Carter started a twitter spaces chat. With thousands of people joining and tagging the President it wasn’t long before Nayib Bukele decided to join. While the parliament was debating the new law The President of El Salvador was on twitter answering questions from people around the world. This is the video of the applause in the parliament after the vote ended.

The front pages of the papers are going to be tightly held collectors items for those able to obtain a physical copy.

It could be weeks or months before we get to see how well they can implement bitcoin being their national currency but it’s going to be interesting to watch. The wider implications could take as long to be realised. Now that bitcoin is in effect a foreign currency does that change the debate whether bitcoin is a currency or a commodity?

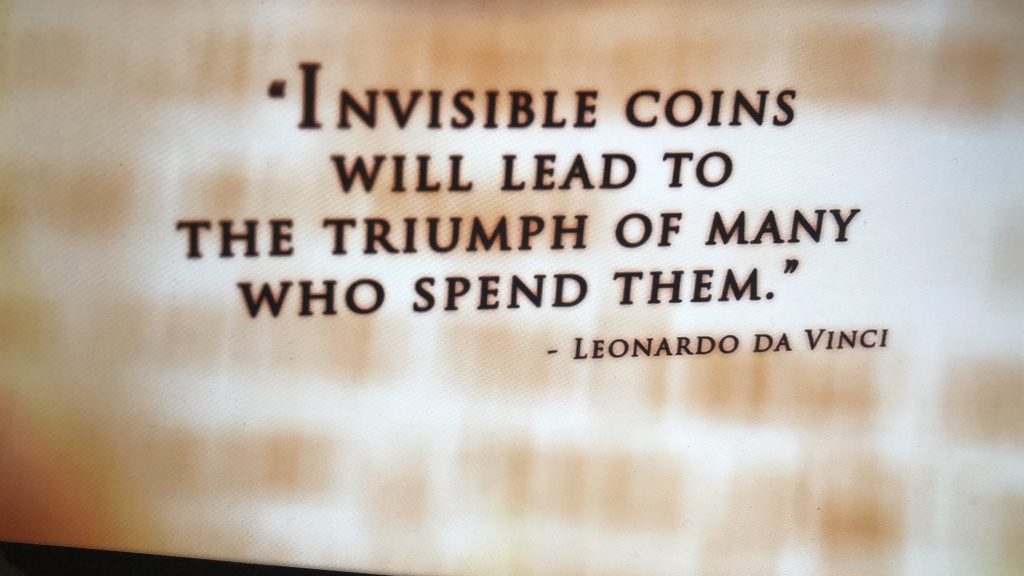

Many will argue bitcoin should only be used as a store of value especially given it’s track record of appreciating by 200% on average every year. A stable coin like USDT or USDC could make more sense for every day transactions. Yet with the amount of money printing the US FED has done since the start of 2020 it’s easy to understand why they have chosen bitcoin for it’s fixed supply. Seeing this quote on twitter on the same day was interesting.

There would be few that would say they were happy they spent their bitcoin in years previous but for the residents of El Salvador it may be a good thing. They will at the very least learn about digital assets quicker and for those who can afford to save some bitcoin rather than cashing it in to live it could be drastically life changing.

Now that one country has officially made bitcoin legal tender, how many will do the same, and how quickly will it happen?

Would you like to listen to the audio call?