11 months down one to go for 2020. Anything could still happen with the world markets before the year ends for multiple reasons but I’m happy with the year that has been.

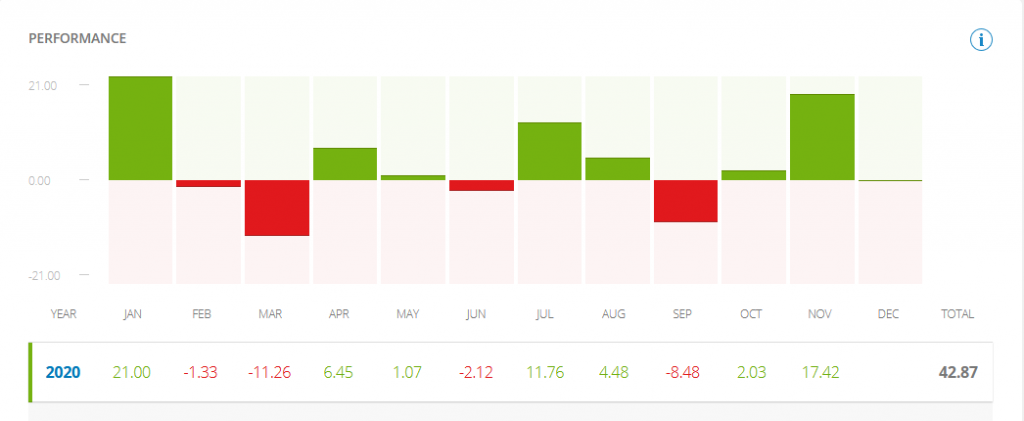

This is an example of a Stocks/Metals/Crypto portfolio

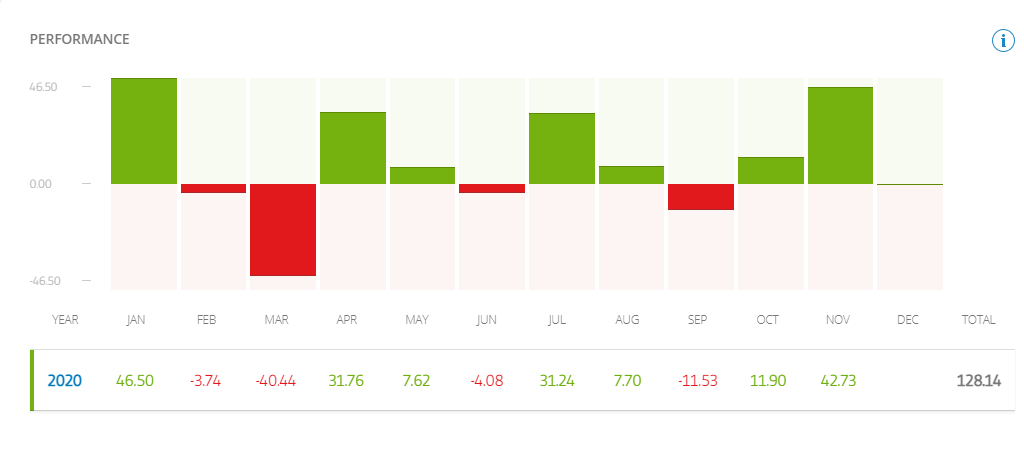

Compare that to a 100% crypto portfolio

All the above numbers are a percentage of open positions in passive accounts. Some positions have been opened and closed during the year but neither is a trading or leveraged account. The drawdowns are a smaller percent in the red months for the diversified account. The Green months are also a lower percentage in the diversified portfolio. So if you can’t handle the wild swings don’t go all in on crypto. That said the 100% crypto is three times the return this year to the diversified one. This is not financial advice just providing you some food for thought.

If you are still considering adding some exposure to cryptocurrencies to your portfolio two of the most interesting reports I saw this year where this one from Fidelity the link to the full report is on that page and this report from CoinShares again the link to the full report is on that page.

As you can see based on their analysis you only needed a small exposure historically to noticeably move the end of year needle on your portfolio.

Again nothing on this site is financial advice I just want you to make informed decisions about your future. This time next year you’ll be able to look book after reading the above two reports and evaluate the decisions you made based on your understanding of the information they have provided. If you don’t invest the time to read them then you will also be able to reflect back on that decision next year.

Make sure you are following AltCoinCollege across Twitter, Facebook and Instagram.